Why Small Businesses Can’t Ignore Customer Verification

As a small business owner, you work hard to build trust with your customers. But do you really know your customers? Today, knowing who you’re doing business with is more than good practice—it’s essential for compliance and security. In today’s regulatory landscape, compliance plays a crucial role for businesses of all sizes. However, many small and medium enterprises (SMEs) are unaware of the full scope of KYC (Know Your Customer), KYB (Know Your Business), and transaction monitoring requirements or how these can impact their operations. This guide breaks down the essentials of these processes, why they’re critical for SMEs, and how TrueKYC provides a simple, efficient solution tailored to meet these needs.

Customer verification isn’t just about protecting your business from fraud—it’s about building secure and trusted relationships. Three core practices—Know Your Customer (KYC), Know Your Business (KYB), and transaction monitoring—are essential for maintaining compliance and ensuring safe business transactions.

What Exactly is KYC?

Know Your Customer, or KYC, is the process of verifying the identity of a business’s customers. This typically involves checking government-issued IDs, verifying addresses, and confirming other personal details to ensure that customers are who they claim to be. KYC is designed to prevent fraud, identity theft, and illegal financial activities, providing businesses with a way to trust the individuals they serve.

Ensuring Safe Business Partnerships

For businesses that work with other companies, KYB is the counterpart to KYC. KYB involves verifying the legitimacy of a business partner, ensuring that a business is registered, reputable, and compliant with regulations. This step is critical for SMEs that rely on partnerships with other businesses and need to avoid entanglements with illegitimate or risky entities.

The Role of Transaction Monitoring in Compliance

Beyond verifying customers and partners, transaction monitoring is the ongoing process of reviewing financial transactions to detect suspicious or irregular activities. This is an essential part of anti-money laundering (AML) compliance, helping businesses identify potential red flags in customer or partner behavior, such as unusually large transactions or patterns that suggest illegal activity.

Why SMEs Need KYC—A Real-World Perspective

For small and medium-sized companies, compliance requirements can feel daunting, especially when resources are limited. However, meeting these regulatory standards is not only necessary but beneficial, providing safeguards for both business and customer.

Imagine you run a currency exchange shop in a bustling downtown, or perhaps you manage a car rental agency near a busy airport. Your customers come and go—some are locals, others are tourists, and a few might be high-profile clients who only visit once in a while. As the owner, you face a challenge: how do you know you can trust each person who walks through your doors? This is where KYC becomes invaluable. KYC is the backbone of a secure business, ensuring that each customer is who they say they are.

For many SMEs like yours, KYC is more than a regulatory requirement—it’s a safeguard for your business. KYC offers peace of mind by ensuring that customers are trustworthy and reliable. This compliance step also builds customer confidence, reduces the risk of fraud, and protects your bottom line.

Many SMEs across industries face similar challenges, including:

Money Transfer Agents and Currency Exchanges: Handling large sums requires verifying customer identities to avoid fraud and ensure regulatory compliance.

Gold and Precious Metal Dealers: High-value items attract high-risk transactions. Gold dealers need to know that each customer is a legitimate buyer, not an individual looking to use their store as a means for illegal activities.

Property Rentals and Car Rentals: Whether renting a property for a weekend getaway or a car for a road trip, verifying customers’ identities is critical. KYC helps property managers and car rental companies know their clients are trustworthy, reducing risks of costly damage or unreturned assets.

Accountants and Notaries: For professionals handling sensitive financial and legal matters, KYC ensures that they’re working with legitimate clients, protecting both their professional reputation and regulatory compliance.

SMEs with Partner Businesses: Some SMEs work closely with other businesses and need to verify the legitimacy of their partners. For example, a small manufacturing company that sources materials from new suppliers can use KYB to ensure these partners are reputable, reducing the risk of fraud or supply chain disruptions.

A Simplified Solution for SMEs

Our platform understands the unique challenges SMEs face, especially those operating physical points of sale or service. While the importance of KYC, KYB, and transaction monitoring is clear, many compliance solutions on the market cater to large corporations, offering complex, feature-heavy platforms that can be overwhelming for smaller businesses. This solution takes a different approach, focusing on simplicity, transparency, and affordability, specifically tailored to meet the needs of small and medium-sized businesses.

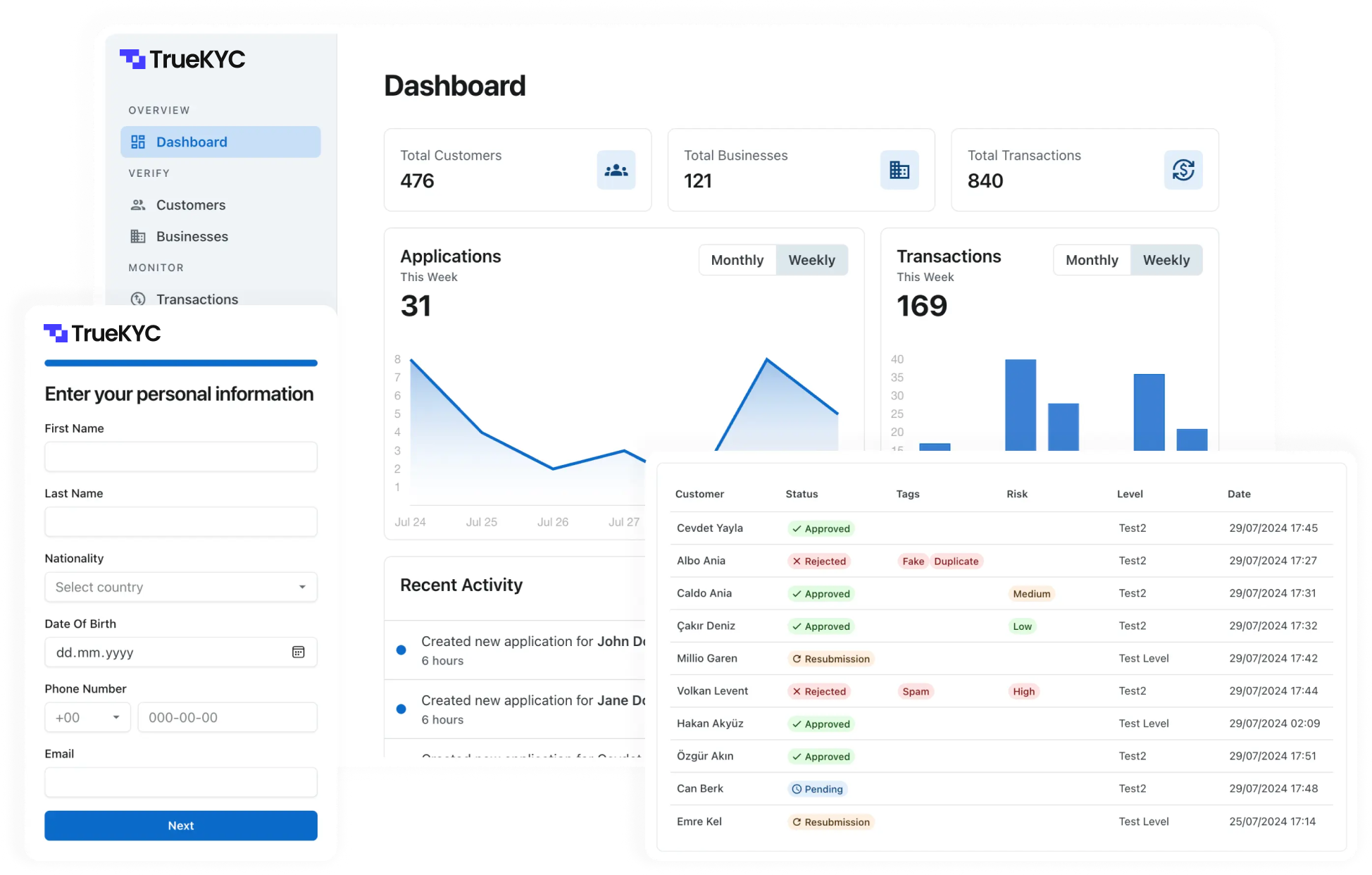

The platform addresses the specific needs of small businesses by offering features that simplify compliance:

Straightforward Onboarding: Designed for ease of use, the platform provides a simple interface and intuitive tools, enabling SMEs to start verifying customers without extensive training. This streamlined approach is ideal for businesses with limited compliance expertise or technical resources.

Predictable Pricing with No Hidden Fees: The solution offers clear, transparent monthly pricing, allowing SMEs to know exactly what they’re paying each month. Unlike other platforms that may come with hidden costs or usage-based fees, this budget-friendly model keeps costs predictable.

Flexible Verification Options: With support for both remote and on-site verifications, the platform provides SMEs the flexibility needed to verify customers and partners based on operational demands. Whether verifying a customer remotely before a car rental or on-site at a currency exchange, the system adapts to fit any business model.

Efficient KYB and Transaction Monitoring: Built-in KYB tools allow businesses to vet partners effectively, while real-time transaction monitoring detects suspicious activities. These features are essential for SMEs that need to manage compliance risk while maintaining secure, reliable business relationships.

High Standards of Data Security: Employing advanced encryption and privacy protocols, this solution safeguards sensitive customer data, ensuring SMEs remain compliant with privacy regulations such as GDPR.

Compliance with Confidence

With this platform, SMEs can manage compliance confidently, knowing they’re equipped with a secure, cost-effective solution that grows with their business. By simplifying compliance, the platform empowers SMEs to focus on what they do best, with the peace of mind that they’re compliant and secure. Explore how this solution can transform your compliance process today.