Understanding Money Laundering: The Role of KYC in Safeguarding Businesses

Money laundering is a global issue that enables criminals to disguise illicitly obtained funds and integrate them into the legitimate financial system. This crime funds terrorism, corruption, and organized crime, posing significant risks to economies and businesses alike. Understanding and addressing money laundering, especially by implementing Know Your Customer (KYC) protocols, is vital for businesses—particularly small ones.

This guide will explore:

- What is Money Laundering?

- Illustrations of Money Laundering in Action

- Global Data on Money Laundering

- Stages of Money Laundering: A Detailed Breakdown

- Common Money Laundering Schemes Across Industries

- How to Detect and Prevent Money Laundering

- The Importance of KYC for Small Businesses

- TrueKYC: Simplifying Compliance for Small Enterprises

1. What is Money Laundering?

Money laundering is the process of disguising illegally obtained money to make it appear legitimate. Criminals use it to fund illegal activities such as drug trafficking, terrorism, and human trafficking or to enjoy the proceeds of crime without drawing attention.

Key Definitions

- United Nations Office on Drugs and Crime (UNODC):

Money laundering is any act or attempted act to disguise the identity of illegally obtained proceeds so they appear to come from legitimate sources. - Financial Action Task Force (FATF):

Money laundering involves the movement of illicit funds through financial systems to conceal their origin and make them appear legitimate.

2. Common Money Laundering Schemes

Money laundering schemes vary widely across industries and often exploit loopholes in regulations or oversight. Below are detailed descriptions of the most common laundering methods:

a. Financial Institutions

Banks and financial institutions are prime targets for money laundering due to their role in processing large volumes of transactions. Criminals exploit gaps in monitoring systems to transfer illicit funds.

Methods:

- Structuring or Smurfing: Breaking large sums into smaller deposits spread across multiple bank accounts to evade detection thresholds.

- Shell Accounts: Using fake identities or stolen information to open bank accounts and move money across jurisdictions.

- Offshore Banking: Leveraging countries with lax financial regulations to transfer and store funds anonymously.

Example:

A criminal deposits $9,900 (just below the $10,000 reporting threshold) into 10 different accounts at separate banks. Over time, these funds are wired to an offshore account in a tax haven.

b. Real Estate

The real estate sector is a common avenue for laundering due to the high value and liquidity of property transactions. Criminals can easily integrate illicit funds by purchasing, developing, or reselling properties.

Methods:

- Property Flipping: Buying properties with illicit money, then selling them at inflated prices to clean the funds.

- Using Shell Companies: Purchasing properties through anonymous corporate entities to obscure ownership.

- Mortgage Fraud: Paying off property mortgages with illicit funds, making the property appear as a legitimate investment.

Example:

A corrupt official channels bribe money into a shell company and buys a luxury villa. The property is rented out, and the rental income is declared as legitimate business revenue.

c. Trade-Based Money Laundering (TBML)

TBML involves misusing international trade to move funds. Criminals manipulate invoices, goods, and shipping to disguise the movement of money.

Methods:

- Over-Invoicing: Declaring goods as more expensive than they are, allowing extra money to be transferred as “payment.”

- Under-Invoicing: Reporting goods at a lower value to move funds undetected.

- Phantom Shipments: Reporting goods as exported/imported when no actual shipment occurs.

Example:

A company declares $1 million worth of goods exported to a foreign client, but the actual value is only $100,000. The remaining $900,000 is illicit money disguised as trade revenue.

d. Gambling and Casinos

Gambling establishments, both physical and online, are frequently used for money laundering due to their cash-heavy nature.

Methods:

- Casino Chips: Launderers purchase chips with illicit money, gamble minimally, and cash out the chips as “winnings.”

- Online Gambling Platforms: Criminals use online betting accounts to deposit illegal funds, place low-risk bets, and withdraw clean money.

Example:

A money launderer purchases $500,000 worth of casino chips, plays for an hour, and cashes out $490,000. The casino issues a check for the “winnings,” making the funds appear legitimate.

e. Money Mules

Money mules are individuals used to transfer or move funds on behalf of criminals, often without understanding the implications.

Methods:

- Recruitment through Job Ads: Criminals advertise fake job opportunities and instruct recruits to process payments.

- Gig Economy Workers: Freelancers and gig workers are targeted to move money internationally.

Example:

A student applies for a “remote financial processing” job. They are asked to receive $10,000 in their account and transfer it to an overseas account, keeping $500 as a “processing fee.”

f. Sports Sponsorships

The sports industry is increasingly targeted for money laundering, particularly through inflated fees and fraudulent sponsorships.

Methods:

- Inflated Transfer Fees: Overstating player transfer fees to move funds between accounts.

- Fake Sponsorship Deals: Sponsorship agreements with little-known companies are used to funnel illicit money into clubs.

Example:

A football club transfers a player for $20 million, far exceeding their market value. The funds are traced back to an offshore account linked to a criminal syndicate.

g. Cryptocurrency

The rise of decentralized finance and digital currencies has created new opportunities for laundering money. Cryptocurrencies allow anonymity and can bypass traditional financial systems.

Methods:

- Mixers and Tumblers: Breaking transactions into smaller parts to obscure the origin of funds.

- Decentralized Exchanges: Using peer-to-peer exchanges that lack regulatory oversight.

- NFT Sales: Using non-fungible tokens to inflate prices artificially and clean dirty money.

Example:

A hacker converts $5 million in stolen funds into Bitcoin, transfers it through multiple wallets, and cashes out via a peer-to-peer platform in another country.

h. Luxury Goods and High-Value Commodities

Criminals often launder money by purchasing expensive items like art, jewelry, gold, and luxury cars. These items retain value and can be sold later for clean funds.

Methods:

- Art Auctions: Buying high-value artwork and reselling it at legitimate auctions.

- Gold Purchases: Buying large quantities of gold bars and melting them into untraceable forms.

- Luxury Car Sales: Purchasing expensive vehicles with cash and reselling them in another jurisdiction.

Example:

A criminal spends $2 million in cash on rare paintings and later sells them at an international auction, presenting the proceeds as legitimate.

i. Cash-Intensive Businesses

Businesses that handle large amounts of cash, such as restaurants, car washes, and bars, are ideal for laundering money. The constant flow of cash makes it easy to mix illicit funds with legitimate income.

Methods:

- Fake Transactions: Reporting inflated sales figures to justify large deposits.

- Employee Fraud: Adding “ghost employees” on payroll and funneling money through them.

Example:

A bar reports nightly sales of $15,000 when actual sales are only $5,000. The extra $10,000 comes from illicit funds, appearing as legitimate earnings.

3. Global Data on Money Laundering

The scale of money laundering worldwide is staggering:

- $800 billion to $2 trillion is laundered annually, according to the UNODC, amounting to 2–5% of global GDP.

- Europol reports that only 1.1% of criminal proceeds are confiscated, leaving billions undetected.

- The U.S. Treasury estimates over $300 billion in illicit funds flow through its financial systems each year.

4. Stages of Money Laundering

Money laundering is carried out in three distinct stages: Placement, Layering, and Integration. Each stage serves a specific purpose in disguising the illicit origins of the money.

a. Placement

The first stage involves introducing illicit money into the financial system. This is the riskiest step as large cash transactions are more likely to attract scrutiny from regulators and financial institutions.

Key Characteristics:

- Breaking large sums of cash into smaller deposits (smurfing) to avoid triggering reporting requirements.

- Funneling cash through businesses like casinos or car washes, where it can appear as legitimate revenue.

- Physically transporting cash across borders to deposit in countries with weaker AML laws.

b. Layering

Layering obscures the money trail by creating a series of financial transactions, making the funds harder to trace.

Key Characteristics:

- Transferring money through multiple accounts, often in different jurisdictions.

- Using shell companies and offshore accounts to hide the ownership of funds.

- Converting money into different currencies, assets, or cryptocurrencies to further complicate tracking.

c. Integration

The final stage reintroduces the laundered money into the economy as legitimate funds.

Key Characteristics:

- Investing in legal businesses or properties to show clean profits.

- Using fake business revenues to justify large deposits.

- Purchasing luxury goods or services to seamlessly integrate funds.

5. How to Detect and Prevent Money Laundering

Detecting and preventing money laundering requires businesses to adopt robust systems and processes. Below are actionable steps to enhance your anti-money laundering (AML) efforts:

Detecting Money Laundering

- Transaction Monitoring:

Use automated tools to identify unusual patterns, such as large or frequent deposits from unknown sources. - Red Flags:

Be vigilant for:

- Clients refusing to provide full identification.

- Transactions involving high-risk jurisdictions.

- Accounts with unusual cash flows, particularly in industries like retail or trade.

- Customer Due Diligence (CDD):

Verify customer identities during onboarding and conduct ongoing monitoring of their financial activities.

Preventing Money Laundering

- Implement KYC and KYB Protocols:

Establish identity verification measures for both customers (KYC) and businesses (KYB) to mitigate risks. - Regular Training:

Train employees to recognize red flags and understand AML laws. - Collaboration with Authorities:

Report suspicious activities to financial regulators or AML authorities to ensure compliance. - Perform Regular Compliance Audits:

Review and update your internal policies and practices to align with the latest AML regulations.

6. The Importance of KYC for Small Businesses

Small businesses are particularly vulnerable to money laundering activities. Criminals often target these businesses due to their perceived lack of robust compliance measures and resources to detect illicit activities. Implementing Know Your Customer (KYC) processes is essential for small businesses to safeguard their operations, protect their reputation, and maintain regulatory compliance.

Why KYC Matters for Small Businesses

- Compliance with Anti-Money Laundering (AML) Regulations

- Governments worldwide enforce strict AML laws to combat financial crimes. Non-compliance can lead to hefty fines, legal repercussions, and even business closures.

- KYC ensures that small businesses can meet regulatory obligations by verifying customer identities and documenting financial transactions.

- Example: In 2022, a small financial services firm in Europe was fined €500,000 for failing to implement adequate KYC checks, leading to their services being used by criminal networks.

- Mitigating Fraud and Financial Crime Risks

- Without KYC, small businesses risk being unknowingly involved in money laundering schemes, damaging their operations and reputation.

- KYC helps identify suspicious patterns, such as fake identities or unusual transactions, before they cause harm.

- Example: A currency exchange business detected a money laundering attempt when a customer tried to exchange large sums of cash under a false identity.

- Building Trust with Stakeholders

- Customers and business partners are more likely to work with organizations that prioritize transparency and compliance.

- Adopting KYC practices sends a strong message about a business’s commitment to ethical operations.

- Example: A luxury retail store implemented KYC checks for high-value transactions, improving trust with clients and attracting more reputable buyers.

- Preventing Reputational Damage

- Being associated with money laundering can irreparably harm a business’s reputation, leading to loss of customers and partnerships.

- KYC allows businesses to avoid being inadvertently linked to criminal activities.

- Example: A law firm faced a public scandal after it unknowingly facilitated transactions for a client involved in money laundering. Proper KYC measures could have flagged the suspicious activity early.

- Access to Financial Services

- Banks and financial institutions are increasingly demanding KYC compliance from businesses before providing services.

- Small businesses with robust KYC protocols are more likely to gain access to loans, credit lines, and payment processing services.

- Example: A supply chain company secured better credit terms after demonstrating their compliance with KYC and AML practices.

High-Risk Industries for Small Businesses

Certain industries face heightened risks of money laundering and are particularly reliant on KYC to protect themselves:

- Accountants and Legal Firms: Handle client funds, settlements, and trusts, making them vulnerable to laundering schemes.

- Currency Exchanges and Gold Dealers: High volumes of cash and valuable commodities attract money launderers.

- Luxury Retailers: High-value transactions for jewelry, watches, and cars can be used to launder money.

- Supply Chains and Logistics: Trade-based money laundering schemes often exploit supply chain businesses.

- Freelance and Gig Economy Platforms: Criminals may pose as clients or workers to launder money.

How KYC Helps Small Businesses Thrive

Implementing KYC is not just about compliance—it is a strategic tool that:

- Strengthens business integrity: By ensuring transparency and ethical practices.

- Promotes long-term growth: By building trust with customers, regulators, and partners.

- Protects financial health: By mitigating risks of fraud and money laundering.

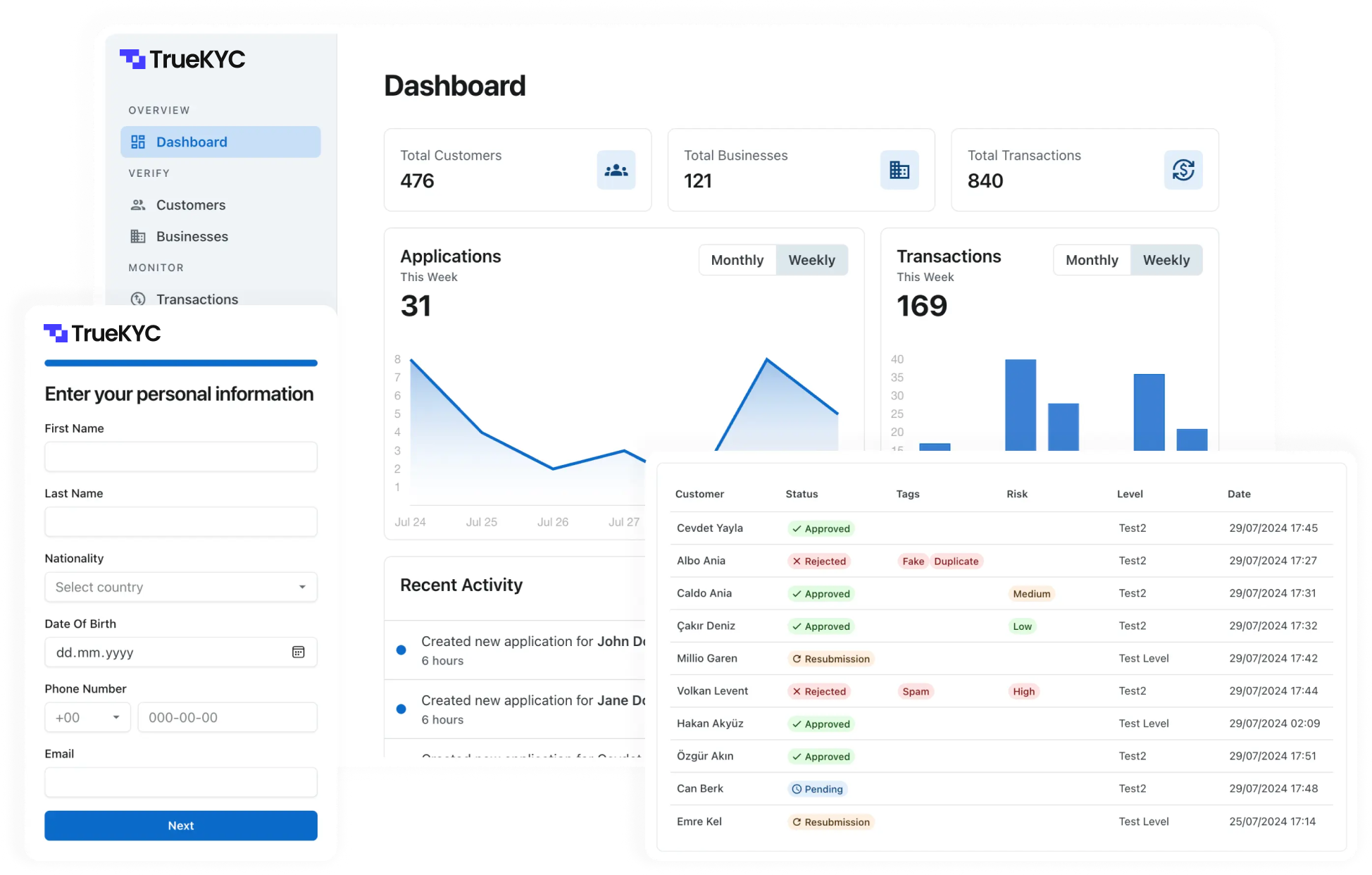

7. TrueKYC: Affordable and Effective Compliance Solutions

TrueKYC simplifies compliance for small businesses, offering tools to fight money laundering effectively.

Key Features

- Customer Verification: Authenticate identities to ensure compliance.

- Business Verification: Verify legitimacy and ownership structures.

- Remote KYC & KYB: Conduct verifications from anywhere.

- Transaction Monitoring: Flag suspicious financial activities.

- Customized Verification Levels: Tailor verification to customer and business needs.