Why Investors and Startups Need Compliance Solutions ?

In the fast-paced world of the startup ecosystem, compliance and risk management play a crucial role in fostering trust, securing investments, and ensuring sustainable growth. With increasing regulations and a heightened focus on transparency, adopting Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions is essential for conducting thorough background checks on startup shareholders and venture capitals (VCs), mitigating risks, and maintaining the integrity of financial transactions. Compliance solutions are not just about meeting regulatory requirements but also about enabling informed decision-making and protecting reputations in a highly competitive environment. In this blog, we will focus on the compliance needs of investors and startups.

The Size of the Startup Market

The global startup ecosystem is massive and growing rapidly. In 2023 alone, startups raised over $445 billion in venture capital funding, with angel investors and family offices contributing a significant share of this total. Family offices, which often manage multi-million to billion-dollar portfolios, are increasingly participating in early-stage and growth-stage investments. With such substantial investment volumes, the need for robust compliance processes cannot be overstated.

1. Ensuring Regulatory Compliance

Venture capitalists and startup founders often operate in jurisdictions with strict financial regulations. These include mandatory KYC and AML checks for investors, founders, and other stakeholders. Compliance ensures:

- Adherence to local and international laws.

- Avoidance of penalties and legal repercussions.

- Maintenance of a clean operational record.

For example, failing to conduct proper due diligence on portfolio companies could lead to unintentional associations with money laundering activities.

2. Mitigating Fraud Risks

Investment fraud is a growing concern, particularly in early-stage ventures where financials and operations may not be fully transparent. KYC and AML processes help validate the identities and conduct background checks on stakeholders, reducing the risk of:

- Fraudulent claims by startups

- Fake identities or shell companies

- Misuse of funds for illicit purposes

3. Protecting Reputation

A investor and startup shareholders reputation is a cornerstone of their business. Associations with questionable entities or individuals can lead to reputational damage, which may:

- Harm relationships with Limited Partners (LPs).

- Reduce access to quality deal flow.

- Attract negative media attention.

KYC and AML solutions act as safeguards against such risks by identifying red flags early.

4. Cross-Border Investment Challenges

Global investments bring immense opportunities but also increased compliance complexities. Each country has distinct KYC and AML requirements, and non-compliance in one jurisdiction can have cascading effects. Automated KYC and AML tools simplify:

- Identity verification across multiple countries.

- Compliance with local regulations.

- Monitoring of cross-border financial transactions.

5. EDD for Venture Capitals

Venture Capitals often conduct extensive due diligence before investing in startups. KYC and AML solutions add an extra layer of scrutiny by providing:

- Background checks on co-founders and shareholders.

- Verification of company registration and ownership.

- Screening for adverse media and sanctions.

This ensures that VCs avoid high-risk ventures and make informed decisions.

6. Why Startups Need AML Tools

Startup founders often engage with independent angel investors, venture funds, and family offices. An AML tool is invaluable for them to:

- Conduct background checks on potential investors, including VC shareholders.

- Ensure that investor funds are from legitimate sources.

- Protect their company’s reputation by avoiding partnerships with high-risk individuals or entities.

By leveraging AML solutions, founders can build trust with stakeholders, streamline fundraising processes, and ensure long-term growth.

7. Screening for Politically Exposed Persons (PEPs)

Investments involving Politically Exposed Persons (PEPs) carry higher risks due to potential corruption or undue influence. AML tools can:

- Identify PEPs among founders, investors, or partners.

- Assess the level of risk and recommend mitigation measures.

- Monitor ongoing activities for compliance.

8. Facilitating Fundraising Transparency

When Investors and startup co-founders raise or receive funds, demonstrating adherence to KYC and AML standards builds trust. It assures stakeholders that:

- The fund’s operations are transparent.

- Risks are actively managed.

- Investments align with ethical standards.

Tailored KYC and AML Solutions from Truezone

Truezone specializes in SaaS compliance tools for offline businesses and offers tailored solutions for investors and founders. Our portfolio includes:

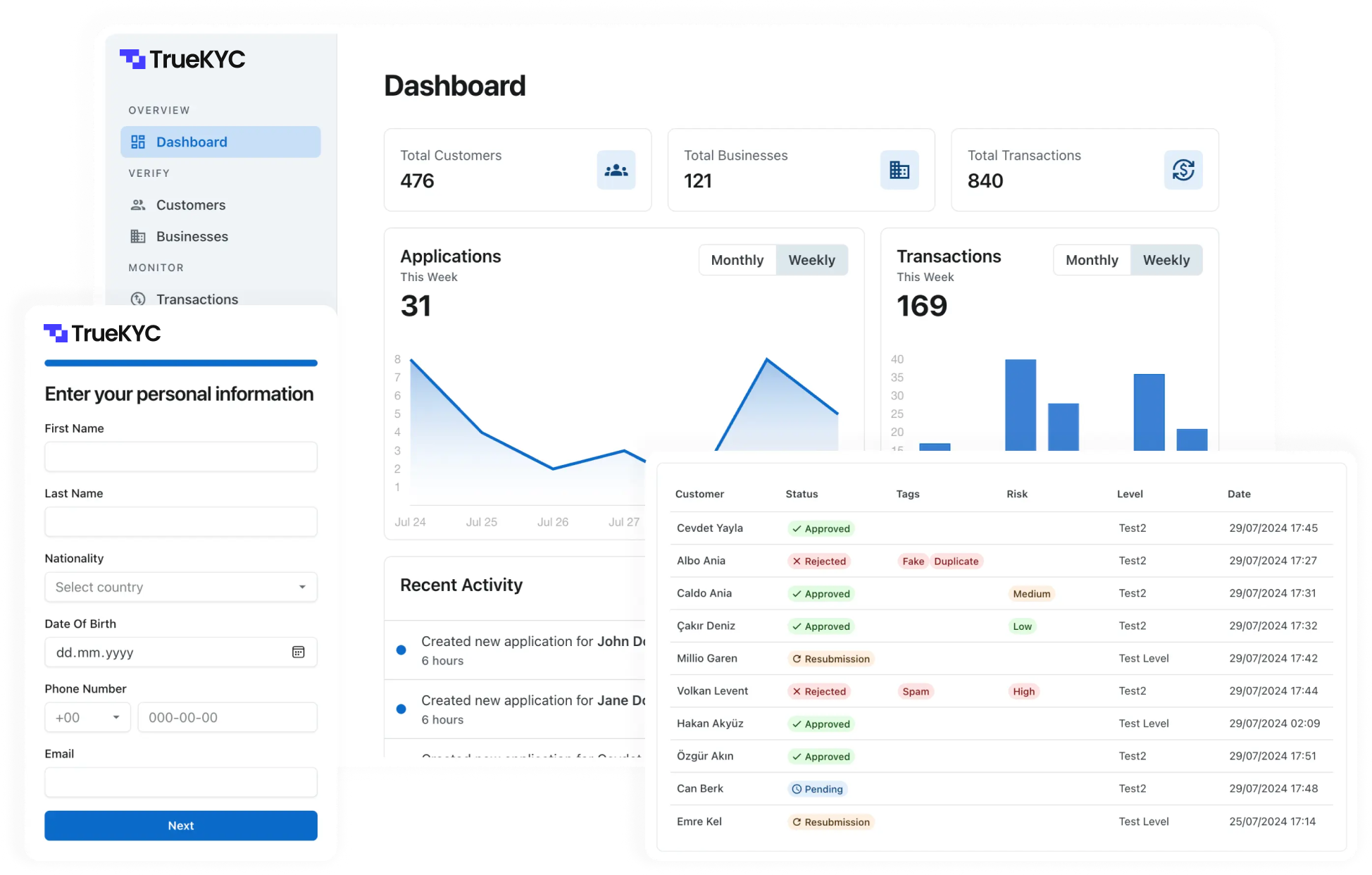

TrueKYC: SaaS platform that provides comprehensive KYC (Know Your Customer), KYB (Know Your Business), and transaction monitoring services. It is designed to help investors and startups ensure compliance with regulatory requirements.

TrueCheck: Currently under development and set to launch in January 2025, TrueCheck is an AML screening platform that will enable to screen entities across over 250 global sanction lists. It will also allow customers to check criminal lists, identify Politically Exposed Persons (PEPs), and verify sanctioned cryptocurrency wallet addresses. This robust platform will empower investors and founders to stay ahead of compliance risks.

Conclusion

KYC and AML solutions are no longer optional for investors and startups; they are essential tools for navigating the complexities of the modern investment landscape. By adopting compliance solutions, both parties can mitigate risks and build trust in their relationships, paving the way for sustainable and ethical growth.

Truezone’s platforms, including TrueKYC and the upcoming TrueCheck, simplify compliance processes for startup ecosystem.