Global Compliance Obligations for Accountants

Accountants today play a crucial role in helping businesses navigate complex financial and regulatory landscapes. Traditionally, accountants were focused on managing finances, tax guidance, and reporting. However, they now hold additional responsibilities to verify the legitimacy of the businesses they serve, assess ownership structures, and monitor transactions to prevent fraud, tax evasion, and other financial crimes.

These responsibilities fall under Know Your Business (KYB) requirements, which mandate accountants to confirm that their clients are legally registered businesses, identify the individuals behind these entities, and ensure transactions align with compliance standards. With KYB regulations varying globally, accountants in countries across Europe, the United States, Singapore, Australia, Canada, Turkey, and other parts of Asia all face unique obligations. These regulations require them to perform due diligence, monitor business activities, and stay compliant with local laws to support a secure financial environment.

In this blog, we’ll explore the KYB obligations for accountants across various countries. These obligations are designed to protect both accountants and their clients, promoting transparency and preventing financial misconduct globally.

KYB Obligations for Accountants

Accountants worldwide are increasingly expected to verify client businesses, identify ownership, and ensure compliance with local regulations. These requirements vary by country, but they all emphasize transparency and financial integrity.

1. European Union KYB Framework

In the European Union, KYB obligations are part of the Anti-Money Laundering Directives, which create a standardized framework for verifying business clients across EU member states.

- Customer Due Diligence (CDD): Accountants must perform due diligence measures, including verifying the identity of business clients and understanding the nature of their business relationship.

- Ultimate Beneficial Owner (UBO) Identification: Accountants are required to identify and verify UBOs—individuals who ultimately own or control a client company.

- Ongoing Monitoring: Accountants must continuously assess business relationships to detect and report suspicious activities.

2. Country-Specific KYB Requirements in Europe

Each EU country implements these directives through national legislation, adding unique requirements for accountants:

Germany: Accountants are required to verify client legitimacy, including business registration and UBO identification, under the country’s anti-money laundering laws.

France: Accountants must confirm client registration, identify UBOs, and monitor transactions to comply with local financial regulations.

Italy: Italian regulations require accountants to conduct client verification and detailed record-keeping.

United Kingdom: Although the UK has left the EU, it still follows strict KYB guidelines that require accountants to verify beneficial owners and track client business activities.

Netherlands: Accountants in the Netherlands are governed by the Dutch Money Laundering and Terrorist Financing (Prevention) Act, which requires verification of UBOs, monitoring of transactions, and detailed record-keeping.

Belgium: In Belgium, the Law of 18 September 2017 on the Prevention of Money Laundering mandates accountants to verify clients’ legal status, document beneficial owners, and report suspicious transactions.

Sweden: The Swedish Anti-Money Laundering Act requires accountants to perform due diligence on clients, verify UBOs, and keep records for several years to support transparency.

Denmark: Danish law mandates that accountants verify the identities of business clients, identify UBOs, and report any suspicious financial activities to authorities.

Austria: In Austria, the Financial Markets Anti-Money Laundering Act requires accountants to conduct due diligence, monitor business relationships, and maintain documentation to verify compliance.

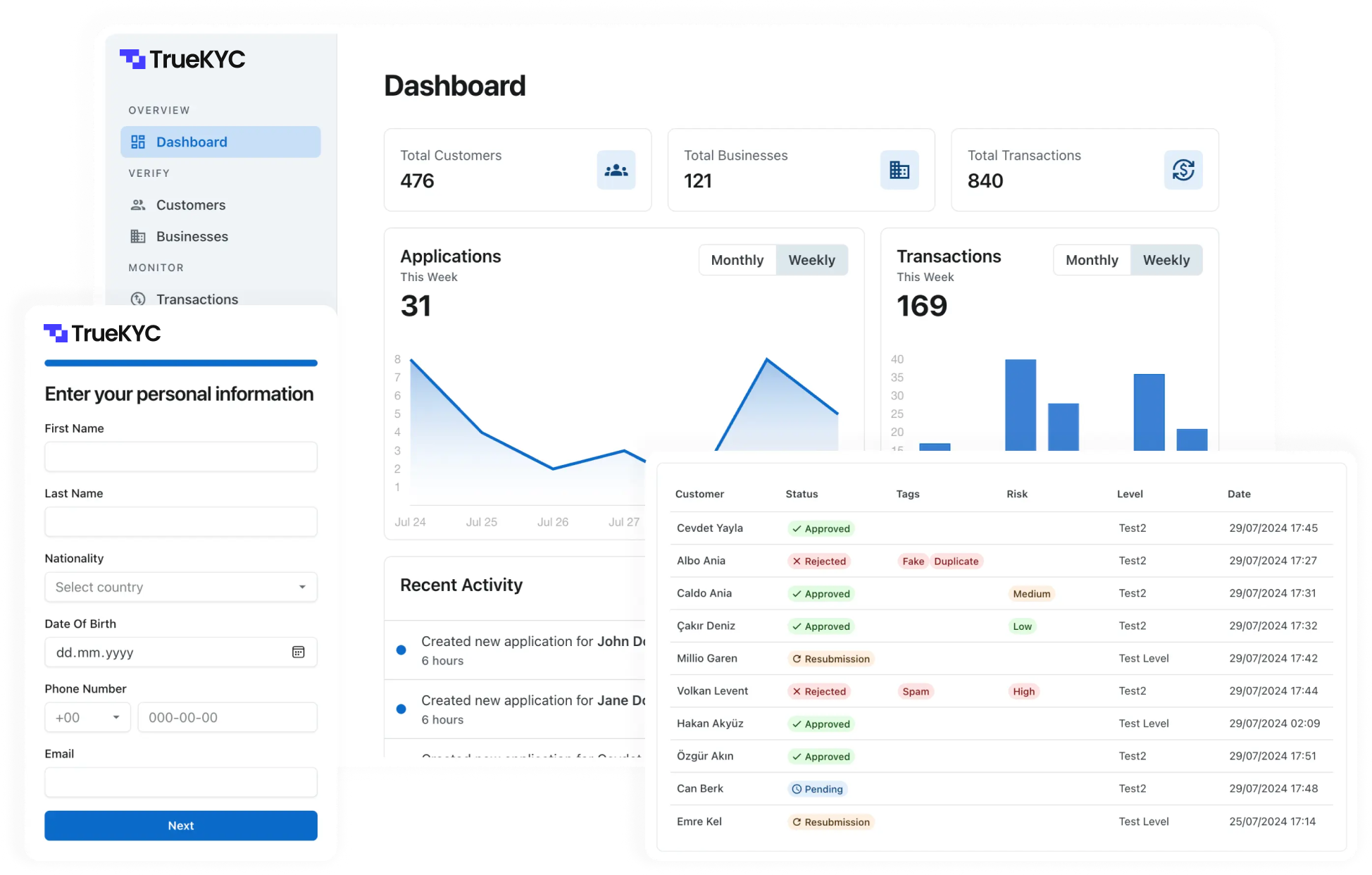

3. Turkey

In Turkey, KYB obligations are governed by the Public Oversight, Accounting and Auditing Standards Authority. Accountants in Turkey are responsible for verifying the legitimacy of their clients, identifying UBOs, and monitoring business transactions to ensure transparency and compliance with Turkish regulations.

- Client Verification: Accountants are required to verify business registration and ensure compliance with Turkish accounting standards.

- UBO Identification: Identifying and verifying UBOs is mandatory to ensure transparency.

- Ongoing Monitoring: Accountants must monitor transactions and report suspicious activities to align with anti-money laundering efforts.

4. Singapore

In Singapore, the Accounting and Corporate Regulatory Authority enforces stringent KYB obligations on accountants to prevent money laundering and terrorist financing.

- Client Verification: Confirm the identity and legitimacy of client businesses.

- UBO Identification: Identify and verify individuals who ultimately own or control client companies.

- Ongoing Monitoring: Continuously monitor client transactions and business relationships for suspicious activities.

5. United States

In the U.S., KYB requirements are enforced under several federal laws aimed at preventing financial crime.

- Customer Due Diligence (CDD) Rule: Requires accountants to verify UBOs and maintain records for client businesses.

- Bank Secrecy Act and USA PATRIOT Act: Mandate customer due diligence, UBO identification, and accurate record-keeping to prevent illegal activities.

6. Australia

In Australia, KYB obligations fall under the Anti-Money Laundering and Counter-Terrorism Financing Act. Accountants must conduct due diligence on their clients, including identifying beneficial owners and maintaining accurate records of client business activities.

7. Canada

Canadian accountants must follow KYB regulations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. Accountants are required to verify client identities, identify beneficial owners, and report suspicious activities.

8. Hong Kong

In Hong Kong, KYB requirements are outlined in the Anti-Money Laundering and Counter-Terrorist Financing Ordinance. Accountants are required to conduct due diligence, including client verification and ongoing monitoring, to ensure clients’ business activities comply with local regulations.

The Importance of KYB Compliance for Accountants

With varying regulations across countries, KYB compliance can seem overwhelming, especially for smaller accounting practices or accountants without a compliance specialization. Yet, KYB compliance is crucial for the following reasons:

1. Protecting Client Relationships and Building Trust

KYB compliance is essential for building trusted relationships. By confirming the legitimacy of each business client, accountants create a transparent relationship with clients, assuring them that their accountant is dedicated to upholding lawful and ethical standards.

2. Avoiding Legal and Financial Risks

Failure to meet KYB obligations can result in substantial penalties and damage to an accountant’s professional reputation. Each country has specific consequences for non-compliance, making it essential for accountants to stay informed and adhere to local regulations.

3. Detecting and Preventing Financial Crimes

KYB processes also allow accountants to monitor transactions, ensuring that any suspicious activities, like unusually large or unexplained transactions, are investigated and reported. This vigilance helps prevent money laundering and fraud, contributing to the stability of the financial system.

4. Enhancing Professional Accountability

Accountants play a crucial role in upholding financial integrity. By complying with KYB requirements, they reinforce the importance of transparency and accountability, solidifying their reputation as protectors of financial trust.

Conclusion: The Path to KYB Compliance

As regulatory demands increase across The World, KYB compliance is no longer optional for accountants. Ensuring client legitimacy is essential for protecting the financial system, building trusted relationships, and supporting a compliant practice.

The key takeaway: accountants who embrace KYB compliance reinforce their commitment to ethical and professional standards. KYB processes help them protect their clients, their practice, and their professional standing, making compliance a vital part of their role in today’s regulatory landscape.